Our services

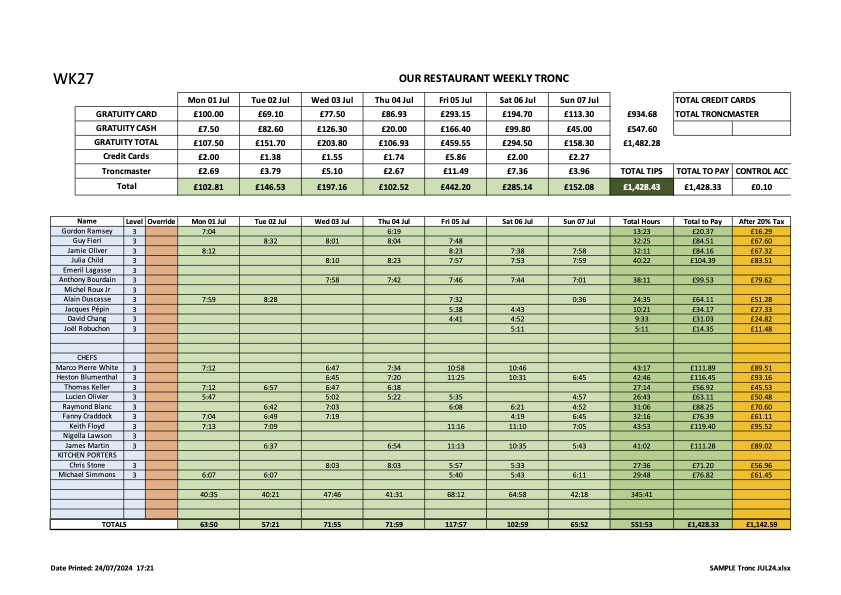

Independent Troncmaster

Changing over to a tronc system or setting up a new restaurant, we can help in all aspects of organising the ratios between house wage and tronc tips. All systems are bespoke to each restaurant and we will be ready for the next monthly payroll.

If you don’t run a tronc system and accept tips through your tills you maybe breaking the law.

Savings on Payroll

We calculate everything for the employees tronc.

The tronc money stays in the company bank account until it is paid by the payroll.

After agreement, our system supplies the payroll with the calculations and it is put on one payslip with the employees salary.

This negates the need for two payrolls, thus saving more money.

Bookkeeping and Wages

We work closely with many accountancy firms around the UK. This enabling us to be able to help in all aspects of bookkeeping and payroll.

Contact us for a free quote on your payroll, it could save you a lot of money

Restaurant Analytics

We provide analytics and advice for restaurants and cafes to help streamline staffing costs and stock control.

Using POS till security and working closely with owners and managers alike we can provide data to help efficiency and savings to busy independent restauranteurs.

What should you be thinking about now?

Do you have a tips policy that is fair and transparent?;

Does it cover all staff including back and front of house, agency staff etc.?

Are employees and customers aware of your tips policy?

Do you operate a tronc and, if so, are you satisfied that it is set up correctly?

Are there any retentions from tips being distributed to the tronc or directly to employees?

If you are not already operating a tronc, do you know what the NIC savings might be for employees and how you can make this work to support with cost of living increases?

Have you checked that other company documentation and policies do not inadvertently undermine the compliance and efficiency of a tronc arrangement (for example, references to tronc and entitlement/amounts mentioned in job adverts, contracts, offer letters, other T&Cs or Policies)?

How are you managing tax and, where relevant, NIC compliance in relation to cash tips?

Have you considered changes (and the associated financial costs) that would be required within your business, should the new Employment (Allocation of Tips) Bill become law?