Why use us?

With over 25 years of experience in restaurants all around the United kingdom, our knowledge of the workings in the catering industry is second to none.

We work closely with bookkeepers and accountants to make a seamless action between the employees in the cafe/restaurant and the owners.

The cost of administering the tronc can be as a percentage of the tronc total or a monthly fee depending on the size of the business and amount of tronc to be organised.

We will supply all employees with an independent tronc contract outlining the rules of the tronc. On a monthly basis, we calculate the amount of PAYE for each employee based on the system in place and submit it to HMRC. They then receive one payslip with their full wage per month.

What is a Tronc?

A tronc is a special arrangement that allows for the fair distribution of tips, gratuities and optional service charges.

The purpose of the tronc is to have an open fair system to divide tips and gratuities between employees independently without the influence of the owners of a business.

If the system is run correctly it will save monies being paid to the Inland Revenue for the employee and employer. It also creates a culture of employees ‘going that extra mile’ to please customers.

Troncmaster

A tronc is run by an independent individual, not the business owner, commonly known as a troncmaster. He or she is in control of the tips and responsible for sharing them amongst employees.

A lot of restaurants use the Restaurant Manager to divide the tips/gratuities which can be open to favouritism and mismanagement.

Ultimately the owner is responsible, if the system is not transparent and fair he/she can be liable to tax collections or fines.

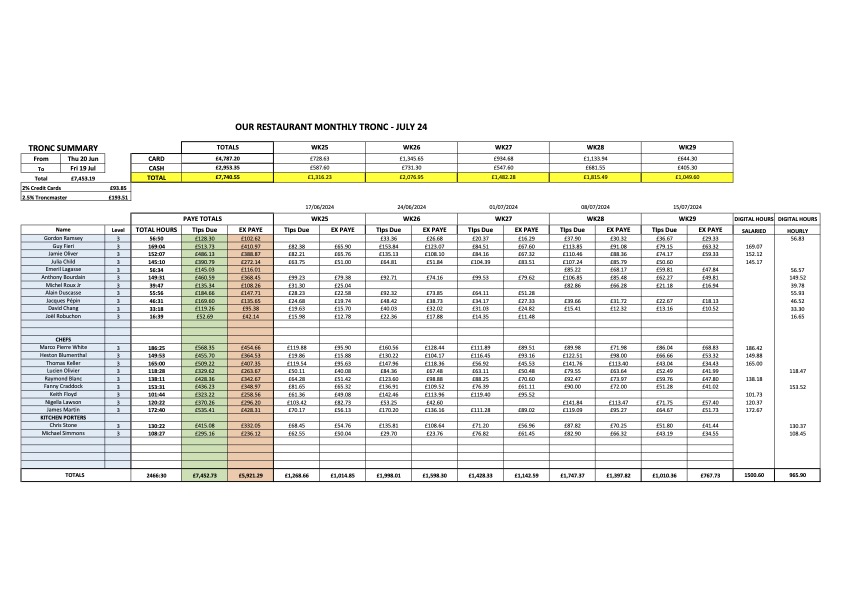

Our Bespoke Spreadsheets

We tailor make all spreadsheets to your establishment needs.

For salaried and hourly staff businesses, our spreadsheets calculate the hours employees work each day to the amount of tronc earned on that corresponding day. This incentivises the employees to give a better service and to work on busier shifts.

We also organise simpler spreadsheets if all staff work the same salaried hours per week and it is a simply divided at the end of the month.

A financial win for all parties

If we take a sum of £100 in customers’ tips as a simple example;

Without a tronc scheme or using a Compulsory Service Charge:-

The whole amount will be subject to VAT of £16.66

The employer, on staff wages, will pay 15.05% National insurance (ERNI)

The employee, on his/her wages, would pay 13.25% in National Insurance (EENI)

The HMRC will collect approximately £45.00, before PAYE, out of the initial £100

Using a tronc scheme to distribute the tips :-

The same £100 would not attract VAT (due to the tips not being the ownership of the establishment).

No employer or employee National insurance contributions due on the tips.

This equates to a large saving on money sent to HMRC thus allowing more money to employer and employees.

With tips often making up a considerable part of a hospitality employee’s take-home pay, this percentage increase is significant, especially as we are in the midst of a cost of living crisis.

What about the costs of the tronc administration?

As you can see from our example, the savings can be considerable. The cost of administering all this through The Tronc is a small percentage of the tips or a fixed fee.

Currently, this can be taken out of the tronc tips pool, prior to the division, and this arrangement would be made clear and agreed upon by the tronc members (employees). However, some clients we have worked with have decided to take on this cost rather than deduct it from the tips pool as a further commitment to their staff.

The much-awaited Employment Bill (Tipping Bill), referring to the allocation of tips, came into force on the 1st October 2024.

It is designed to ensure all tips go to staff by making it unlawful for businesses to hold back tips and service charges from their employees. Costs incurred for managing tips, such as credit card fees and troncmaster fees, are still allowed to be taken from the pooled tips.

There is no time to waste to organise your restaurant, hotel or cafe as if you are not compliant the business could receive a large fine.

If you have an employee’s contract in which service charge percentage is not mentioned in their salary, you needed to change this before the 1st October or the employee could receive the ‘service charge’ on top of their salary.